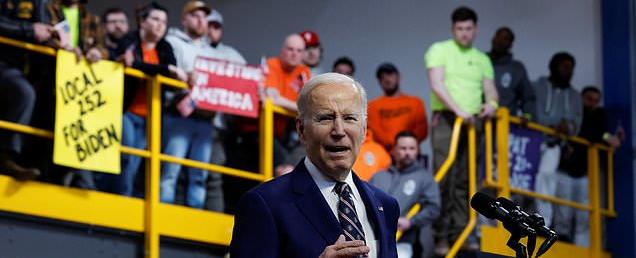

Biden proposes the HIGHEST personal income tax rate since 1986 in $6.8 trillion budget

The US President Joe Biden has proposed an astounding $6.8 trillion budget for the fiscal year 2022 that aims to address the country’s social and economic issues. However, what has caught everyone’s eye is his plan to increase the personal income tax rate to the highest since 1986. The tax hike proposal would target individuals earning more than $452,000 a year, raising their marginal tax rate to 39.6% from the current 37%. The budget also includes an increase in capital gains tax for individuals earning more than a million dollars annually.

This move by the Biden administration is part of its broader agenda of reducing income inequality, providing better healthcare services, and investing in infrastructure. The budget aims to increase the availability of affordable housing, child care, education, and training opportunities, among several other benefits.

However, the proposal has received mixed reactions from individuals and organizations across the political spectrum. While some believe that increasing taxes is necessary to address the country’s issues, others argue that it would ultimately harm the economy by discouraging investment and entrepreneurship.

The proposal is still subject to approval by Congress, so it remains to be seen what the final outcome will be. But one thing is for sure—this budget is going to have significant implications for the country and its citizens. It’s a crucial topic for everyone to follow, as it could impact their finances and quality of life.

Quick Links