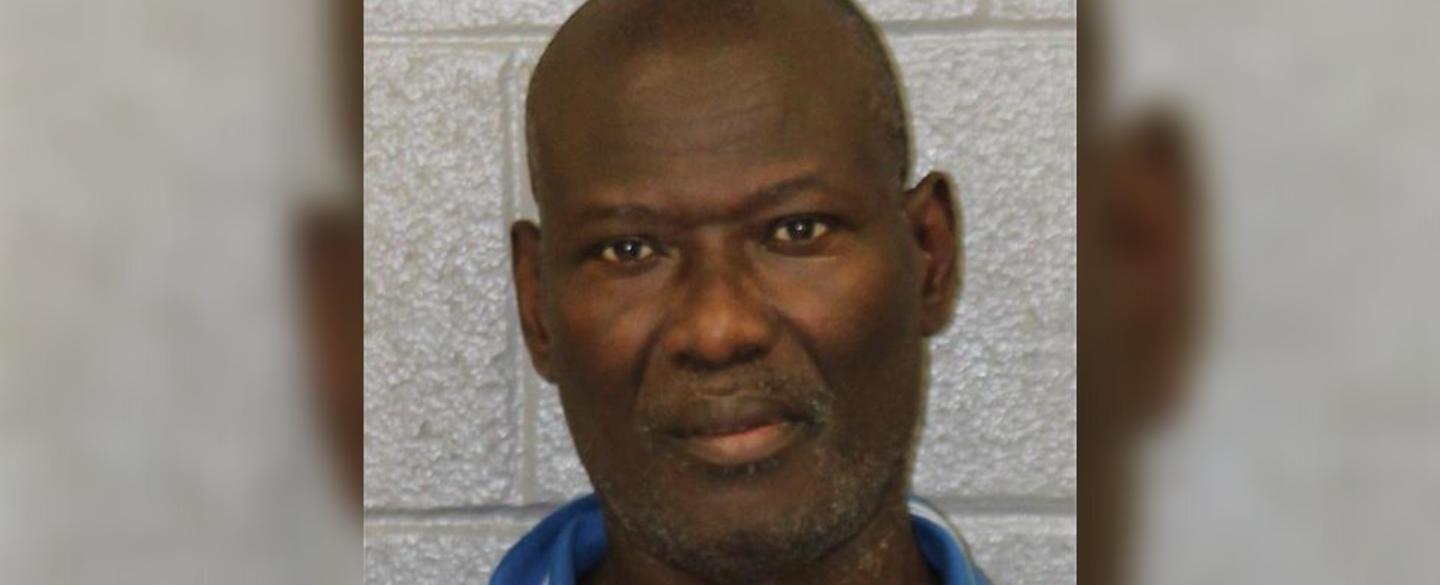

Charlotte man indicted for helping file $4.7M worth of false tax returns

So I read this article about a guy from Charlotte who got indicted for filing bogus tax returns worth a whopping $4.7 million. Can you believe that? Apparently, he was working with a group of people who were using stolen identities to falsely claim tax refunds. Like, talk about a major scam!

From what I gathered, this guy was responsible for quite a bit of the fraudulent activity. The feds say that he helped file nearly 2,000 false returns that included fabricated income, deductions, and even dependents. It’s crazy how people can come up with such elaborate schemes just to make a quick buck.

But what’s even crazier is that the IRS actually caught on to this and was able to track down the culprits. According to the article, the agency has been cracking down on tax fraud in recent years and has been using advanced technology to detect false claims. I guess this just goes to show that crime doesn’t pay.

Personally, I’ve never been involved in anything like this (thankfully), but I do know that filing taxes can be a major headache. I mean, who actually enjoys doing all that paperwork and number crunching? But even if you hate it, it’s important to do it right and be honest about your income and deductions. Otherwise, you might end up like this guy and face serious consequences.

Overall, I think this article is a good reminder of the importance of following the rules and being truthful when it comes to taxes. It’s not worth risking your reputation, your money, or even your freedom. So let’s all take a lesson from this cautionary tale and do our taxes the right way.

Quick Links