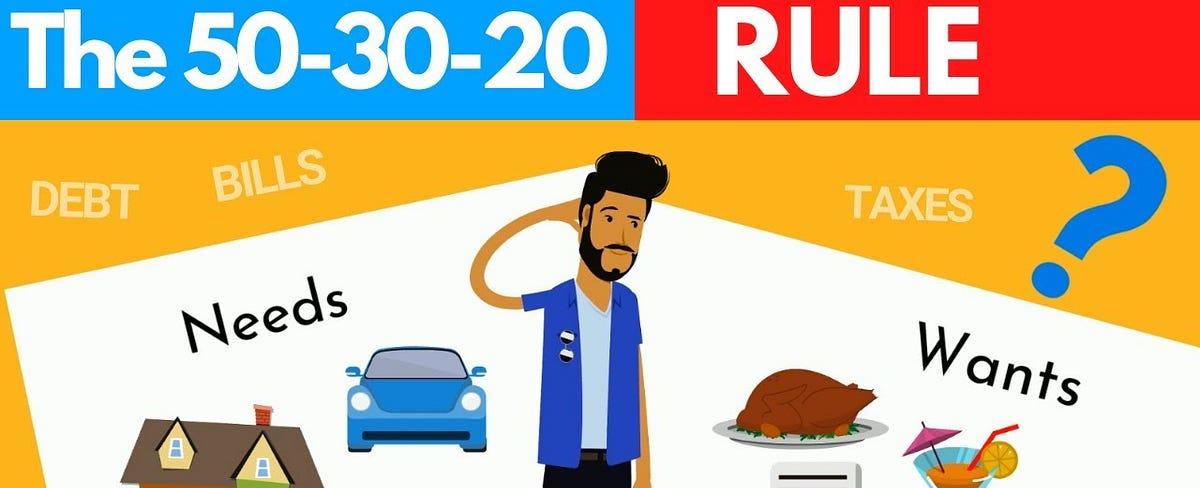

Personal Finance: The 50/30/20 rule of Budgeting.

Personal finance can be a daunting task for many people, especially if they are new to budgeting. However, understanding the basics of budgeting and implementing a sound budgeting strategy can make a world of difference. That’s where the 50/30/20 rule of budgeting comes in. This rule is a simple and effective way to budget your finances and make the most out of your earnings.

The basic principle of this rule is to divide your income into three major categories: necessities, wants, and savings. The first 50% of your income should be allocated for necessities like rent, utilities, groceries, and other bills. The next 30% is for wants like entertainment, dining out, and shopping. The remaining 20% should be set aside for savings. This can include emergency funds, retirement accounts, or investments.

One major advantage of the 50/30/20 rule is that it allows you to prioritize your spending based on your needs. This means you can still enjoy some of life’s luxuries while still being responsible with your budget. Additionally, by saving 20% of your income, you are building a financial cushion for the future and improving your financial well-being.

While this rule may not work for everyone’s unique financial situation, it is a great starting point for those looking to get their finances in order. By adhering to this rule, you can develop good financial habits and take control of your finances. Planning your finances with the 50/30/20 rule can help you achieve your financial goals, whether that be saving for a down payment on a house or planning for retirement.

In conclusion, budgeting is an essential aspect of personal finance and can help you achieve financial security and stability. The 50/30/20 rule is a simple yet effective way to start budgeting, allowing you to prioritize your necessities, wants, and savings. Whether you are a seasoned budgeter or just starting out, this rule can help you reach your financial goals and secure your financial future.

Quick Links